Testimonies & Victims’ Stories

The Human Cost of FINSAC: Evictions, Suicides, and Forgotten Voices

Evictions and Trauma:

IN July 2008 my husband – having gone to court to request time from the supposedly new owner– a connected Manley/PNP affiliate – JOSHUA THOMAS – to find somewhere else to live. He denied us time.

Seven o’clock one morning a bailiff in a truck of men and women just drove in the front yard, barged into our home and started throwing all our stuff outside loading up on a truck they brought. It was pure chaos. In the midst of it I did not see my husband. My attention was focused on getting out of there ASAP.

My husband was so traumatized – he was out the back of the yard just sitting, shaking and staring – in a daze. Thanks to the bailiff – he recognized that ANCAR’s office was being operated out of the home, as, by this time we could not afford the rent for an office. The bailiff proceeded to call JOSHUA THOMAS – the new owner and advised him of that and legally he has to give us time to move the vehicles and equipment that were there – which he eventually did – after some expletives from him.

The events experienced by us that day were prime examples of what were inflicted on MULTIPLE debtors in the following months.

THIS WAS HOW THE GOVERNMENT OF JAMAICA – JLP and PNP – ORGANIZED TAKING AWAY COLLATERAL PROPERTIES OF APPROXIMATELY 44,000 BUSINESS PERSONS.

With these kind of events – the suicide rate and deaths from stress-related illnesses increased exponentially among our members and businesspersons. I would get calls when persons were being thrown out of their homes – so as President of the Association I felt I had a moral responsibility to, if nothing else, be a pillow of comfort and support for them. At some point, and I still do – I felt as if I was carrying the burdens of all 44 thousand entities.

FINSAC & REFIN TRUST Allegations:

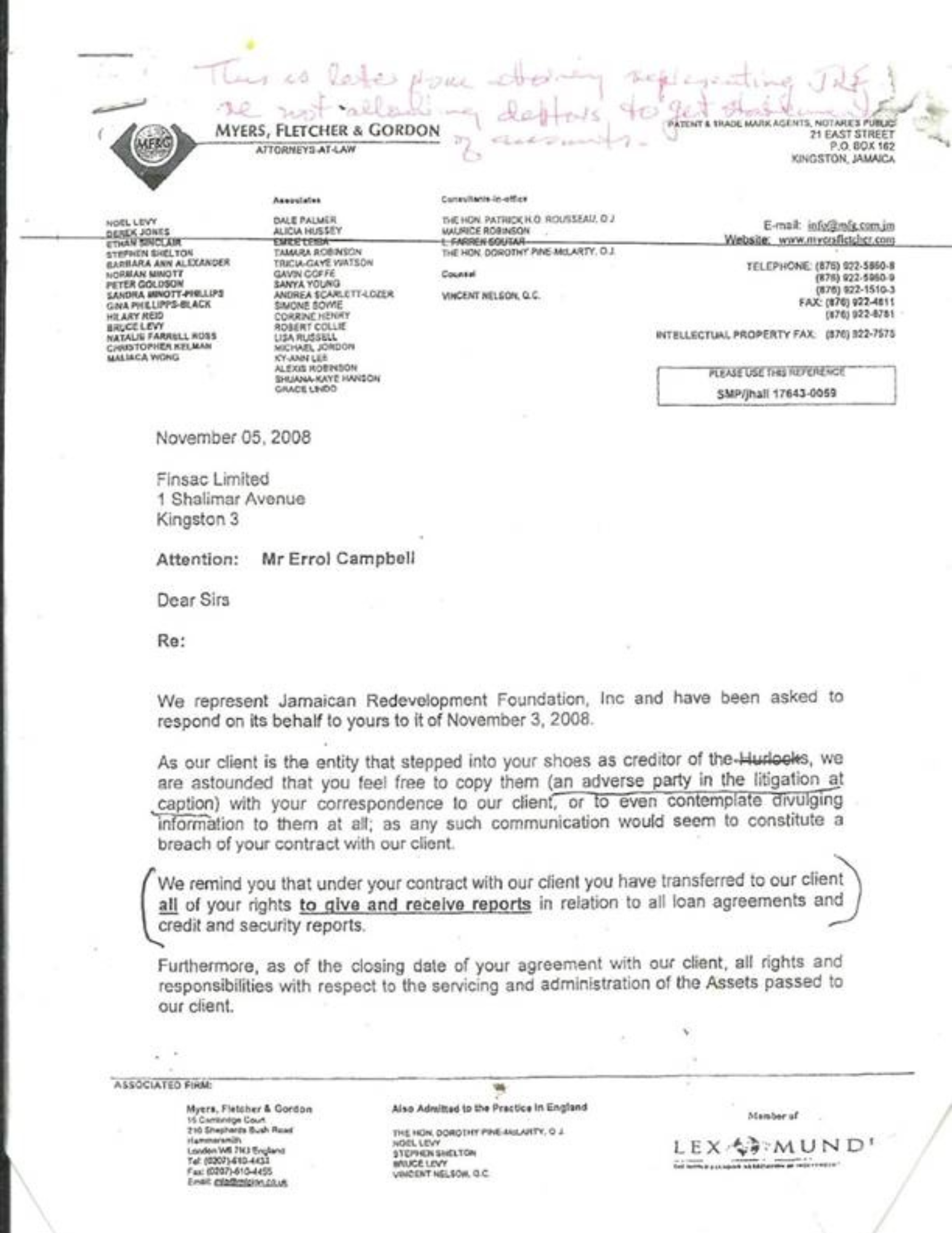

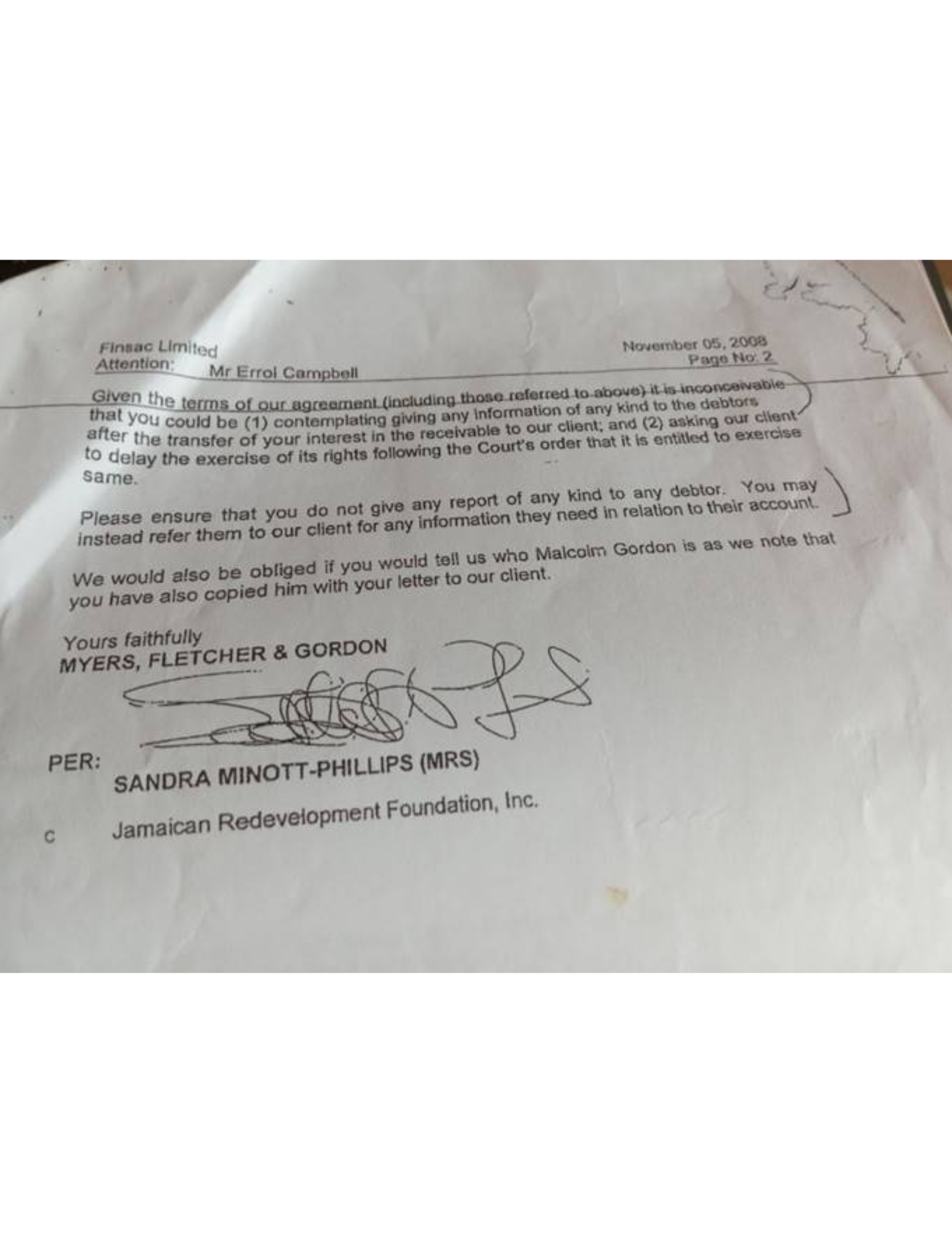

Another entity set up along with FINSAC was REFIN TRUST. What was the purpose of REFIN TRUST? Of note MYERS, FLETCHER & GORDON – one of Jamaica’s largest legal firms was the entity that handled, on behalf of the government, on behalf of Finsac, on behalf of JAMAICA REDEVELOPMENT FOUNDATION and MOST, if NOT ALL legal activities that had to do with the FINSAC debacle, AGAINST debtors.

Of note: – Most if not ALL documents to do with Finsac were/is under the directorship/signature of the wife of a former PNP Finance Minister.

WAS THIS THE ENTITY USED TO TRANSFER PROPERTIES FROM SOME OF THE DEBTORS TITLES TO GOVERNMENT MINISTERS WHO ACQUIRED SOME OF THESE PROPERTIES? AND IF SO – DID THE ACQUIREES PAY FOR THE PROPERTIES? AND IF SO, HOW MUCH?

CONSTITUTIONAL VIOLATIONS

- Debtors were never given Statements of accounts and/or advised prior to the accounts being transferred to Denis Joslin (Beal Bank) and later – Jamaican Redevelopment Foundation (JRF).

NOTE: Debtors. as far as I know, were servicing their accounts at the banking institutions – paying the REQUIRED amounts as were signed in the bank loan agreements.

- It wasn’t until the INTEREST RATES that were signed for increased exponentially – e.g. from 18% to 120% – and for some debtors to 173%, at which time debtors started having difficulties to service their agreed payments. My husband MILTON BAKER borrowed $10 mil. Paid back $52 mil and was told by JRF that he STILL owed $85mil.

- At this point debtors communicated to the various bank managers/personnel to try and arrange for REASONABLE payment plans. Certain bank managers TESTIFIED at the Enquiry that they asked Dr. Omar Davis to give them a chance to work with the debtors. Their requests were never granted. WHY and/or WHY NOT?

HOW WERE THE DEBTORS ACCOUNTS TRANSFERRED TO DENIS JOSLIN/BEAL BANK/JRF?

- Two companies formed by the government – FINSAC, REFIN TRUST.

- My understanding was that Dr. Davis was advised by ERNST & YOUNG – a multinational professional service organization – that “A GOVERNMENT CANNOT FORM A PRIVATE ENTITY AND USE THAT ENTITY TO DISPOSE OF PEOPLE’S PROPERTIES – IT IS ILLEGAL”. Was this what was done? What was the REALpurpose of FINSACand REFIN TRUST? SHOULD DR. OMAR DAVIS BE LEGALLY CHARGED?

- ERROL CAMPBELL (Finsac Manager) testified at the Enquiry, when asked how were debtors’ accounts transferred, stated that “the accounts with the ORIGINALamounts were transferred”. In other words, payments made on the original debt – up to the time – were not a part of the loan portfolio transferred, or was taken into consideration? It’s the ORIGINAL loan amount that was transferred, and JRF started requesting the original loan amounts plus interest that had supposedly accrued from the banking institution and then added their interest charges?

- JAMAICA REDEVELOPMENT FOUNDATION– Are the laws that govern a FOUNDATION applied to JRF? If so what purpose has that FOUNDATION served?

8 Considering that JRF is a DEBT COLLECTION AGENCY and NOT a financial institution – WHY ARE THEY ALLOWED TO CHARGE INTEREST if a debtor decides to make payment agreement with them? IS THE IRS AWARE OF THIS?

If MOST, if not ALL the funds are repatriated back to the US the Usery Laws in the US PROHIBITS a COLLECTION AGENCY from charging interest – FACT.

- Why did Dr. Omar Davis change the MONEY LENDING ACT in order to accommodate JRF?

NOTE: From ONE particular debtor – 17 of his properties were transferred to JRF and in 2020-2021, the gentleman’s wife received an invoice for in excess of $700 million which JRF claimed represented interest charges. This debtor was one that also committed suicide by opting to tell his wife not to give him any more food. He just laid in his bed until he passed from starvation.

NOTE: Several debtors visited the Titles Office and were NEVER able to access their titles.

I learned that titles of compromised properties were stored at an undisclosed location in Kingston

– I think on Connolly Avenue.

Untold Deaths and Suicides

1. Morris Richards

Morris Richards was a well-known builder in the Mandeville area while his wife Grace was a retired librarian. The two had for years operated a business on South Race Course Road which sold household chemicals. They did not show up for church one Sunday morning. After church some members started calling the couple and getting no response, they went to their home – the car was in the driveway – they knocked on the door – and getting no response, decided to call the police. When the police came, they found the couple – both hanging from the ceiling of their home, a note left on their dining table read – “I CANNOT GO ON ONE MORE DAY WITH THE NOOSE OF FINSAC AROUND MY NECK”.

2. gentleman living in Cherry Gardens

Another gentleman living in Cherry Gardens – he knew the day they were coming to throw him and his family out of their home, but he said nothing to his wife and daughter. He got up the morning – went to the gas station and purchased a can with gasolene. Came back home. His wife and daughter were both in the front of the house. He went to a back room – sprinkled the gas all over the room and lit a match and stood there when there was a “boom”. The wife and daughter were lucky enough to run out of the house and were not hurt.

3. Harold Ramsay

Harold Ramsay – a developer/hardware owner from Mandeville was advised by his doctor and his attorney not to attend the Enquiry because he had a heart condition and they knew he could not withstand the stress. He lost 17 properties. He was CUSTOMER OF THE YEAR for two years straight at his bank in Mandeville. When he realized he was losing ALL his life’s work he asked his wife not to give him any more food. He refused to eat. He just laid in his bed and died within a few days.

4. manufacturer of mattress

Another lady who was a manufacturer of mattresses. She called me one morning crying because the bailiffs had shown up to throw her out of her home, just like they had come to ours. When I showed up there to give her moral support – she was standing outside her house, the urine was literally running down her legs and the people who had come to throw her out of her house stood laughing at her. AS A MATTER OF NOTE—HOMEOWNERS WERE NOT ADVISED WHEN THESE HOODLUMS WERE GOING TO SHOW UP.

5. Mr. Mario Hernandez

Mr. Mario Hernandez– a windows manufacturer has been paying on his account and when Jamaica Development Foundation informed him he had a balance of US$12,000. He was able to borrow the funds from family members overseas. He called me on the morning he was on his way to Jamaica Redevelopment Foundation to pay off his loan. About a couple hours later I got a call from his phone number. When I answered the phone with a “hello” I got no response from him. I called his name and when he finally answered – he was crying. He told me “I went down to JRF and I gave them the check for the US$12,000. They took the check and he is waiting for a receipt. They came back and told him he owed additional enormous amounts for interest charges. Mr. Hernandez died of a heart attack within a couple of weeks thereafter. His young wife died within a few months after his death – leaving a young child orphaned.

6. Mr. Mal Levy

Mr. Mal Levy was owner of several plazas, including the Bankhouse Mall in Mandeville. He realized he was fighting a losing battle with his debts, with the bank and FINSAC, and decided to leave Jamaica to live in the U.S., to give his family a better life. He returned to Jamaica a few months later to attend the funeral of a friend. On his way from the funeral he stopped at a friend’s bar to visit with him. He was shot and killed as he stepped out of his car. The family returned to Jamaica to bury him and returned to the US. His wife was very distraught over his death. She returned to Jamaica when she thought she was in a better place after his death. She never made it back to the U.S. She died shortly after she got back to Jamaica. One of their sons died within months after that. It was really taking a toll on their entire family. The pressure of how they have been running several SUCCESSFUL businesses and these are their benefits.

7. Sidney Barnes

Sidney Barnes– Mr. Barnes did not testify at the Enquiry because he did not know he was Finsac’d. He had no loan. It wasn’t until 2012 when JRF sold his property and the new owners came and threw him out of his home and business that he went to the Titles Office to get a copy of his title. They advised him at the Titles Office that his title was not there as ALL titles of finsac’d properties were removed from the office. However, after some amount of searching he got a copy of his title only to realize that the loan of US$120,000 that he borrowed in September 1988 and repaid in full directly to his bank by cheques from his vendors in January 1989, the loan on his title was not registered until June 1989 – 6 months after he repaid the entire loan.

8. Mr. Mescheck Willis

Mr. Mescheck Willis, a handicapped man in his 70s. Mr. Willis was not able to complete his education but he and his wife used to buy and sell products and he would leave Kingston to go to the country to sell. He was doing very well for a person with limited education – to the point where he purchased a beautiful home in Patrick City. He had reached a point where he could hire a helper to come to his home to take care of his kids. With one of his sons attending University of Technology. While he and his wife travelled to sell, he was able to hire a taxi to transport his kids to and from school.

Mr. Willis went to the bank and borrowed J$140,000 because he was getting orders from hotels to make curtains and pillows etc for the hotel. Mr. Willis used his house valued at J$11 million as collateral. The bank manager at the bank that he had dealt with called him one day telling him that he was being transferred to another bank and he thought it would be good if Mr. Willis transfer his account to the bank he was moving to, and Mr. Willis agreed. It wasn’t a few months later that Mr. Willis received a letter from Jamaica Redevelopment Foundation regarding him owing J$11million for loan he supposedly took out using his home as collateral. Mr. Willis was shocked – and of course where would he get J$11mil. His wife, under the stress developed a life-threatening disease and died within a few months.

I personally wrote 2 letters to Andrew Holness asking him to assist Mr. Willis to acquire a decent small home. I personally visited Mr. Audley Shaw’s office while he was Finance Minister to ask him to assist Mr. Willis. Mr. Shaw’s response was that “…if he assisted Mr Willis others are going to expect him to assist them…” Needless to say THERE WAS NO RESPONSE FROM Mr. Holness. It reminds me of the saying ‘MAN TO MAN IS UNJUST, BLACK MAN TO BLACK MAN – TEN TIMES WUS…”

Mr. Willis ended up living in places – cannot be called a home – he had no doors. He had to hang sheets etc to make doors to give them some form of privacy, and using a pit latrine. Mr. Willis is in his late 80s and should not be living alone. But there is not enough space for one of his kids to live with him. The gentleman who took loans on Mr. Willis titles has not been imprisoned.

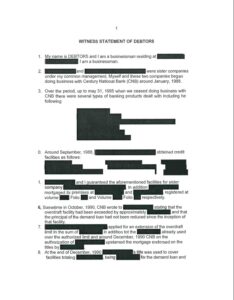

DEBTOR 5's Account: Challenging FINSAC's Claims of Indebtedness

This document presents DEBTOR 5’s witness statement, detailing complex financial dealings with Century National Bank (CNB) and Eagle Merchant Bank (EMB) from 1988 to 1995. DEBTOR 5 contends that his companies were not indebted to CNB at the time of FINSAC’s takeover, asserting that all liabilities were fully satisfied, with evidence of loan overpayments and existing credit balances.

The statement outlines disputes over loan terms, alleged errors in accounting, and subsequent legal challenges initiated by FINSAC, including the sale of properties based on what DEBTOR 5 claims was a fictitious debt.

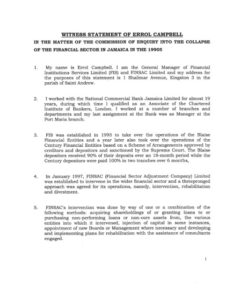

Errol Campbell's FINSAC Testimony: Unanswered Questions on Debtor Engagement and Asset Management

This material presents the witness statement of Errol Campbell, General Manager of FINSAC Limited, submitted during the Commission of Enquiry. Campbell’s testimony details the internal mechanisms and operational units established by FINSAC, including its system for managing vast numbers of financial records and property documents. The statement offers an official account of how FINSAC aimed to handle its responsibilities in the aftermath of the financial crisis.

However, this analysis critically examines Campbell’s statement against the experiences of numerous debtors and the wider public. It highlights key discrepancies, particularly concerning FINSAC’s engagement with debtors, the reported difficulties in obtaining accurate account statements, and the alleged lack of transparency in debt resolution. Furthermore, it raises pointed questions regarding the integrity of record-keeping and the ultimate fate of property titles, probing whether assets were managed impartially or potentially favored specific political interests and their associates.

A Case Study in Collapse: How FINSAC and High-Interest Policies Devastated Jamaica's Insurance Sector

This submission from Oliver Jones provides a detailed and critical account of the Jamaican financial and insurance sectors from 1994 to 1999, leading up to and including the FINSAC intervention. The document highlights a disastrous period for the insurance industry, characterized by a sharp decline in premium income and a significant shift in investments from traditional long-term assets like real estate to government securities. It uses Island Life Insurance Company Limited as a case study, explaining how the company, despite being strong, faced severe operational and investment losses due to high-interest rates and competition from risk-free government paper.

The submission further details a merger proposal that Island Life presented to FINSAC, which was never formally responded to, and concludes by questioning the logic behind giving up ownership of an important national sector to foreign interests. The document serves as a powerful testimony, arguing that the events of this period should be properly documented to understand the true role of FINSAC and the devastating impact it had on the economy.

DEBTOR3’s Testimony: A Vicious Cycle of High Interest and Stalled Negotiations

This witness statement from DEBTOR3 details a protracted and ultimately unsuccessful struggle with FINSAC and the Jamaica Redevelopment Foundation (JRF) to settle his debt. The testimony outlines how a loan from NCB was sold to Recon Trust, a FINSAC subsidiary, and then to JRF. DEBTOR3 describes his strenuous efforts to negotiate a settlement by selling a portion of his land to the government and subdividing the rest, a plan that was continually hampered by a lack of cooperation from the government and JRF.

He highlights how JRF’s refusal to release property titles led to the collapse of potential sales and forced him to refund deposits to buyers. The statement also reveals how the debt ballooned due to a high interest rate, even after a substantial payment from the government. In his closing remarks, DEBTOR3 raises critical questions about the legality of the interest rates, the lack of transparency, and the discriminatory nature of FINSAC’s debt resolution processes.